NASHVILLE, Tenn. (TSU News Service) – For more than 16 years, Sonya Nicole Martin used private accounting firms to prepare her IRS tax return for a fee.

But the last two years, Martin got a break and is now getting her returns done for free by certified IRS tax preparers, thanks to a program in the College of Business at Tennessee State University.

“This is a big help,” says Martin. “It is saving me a lot and I am able to give back to my family and spend that extra money that I am saving on other items.”

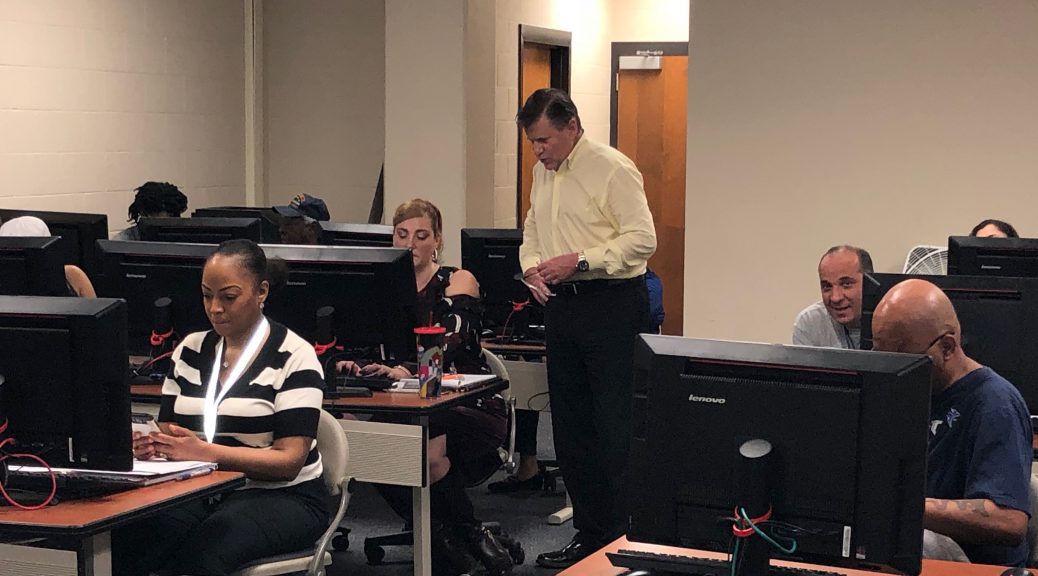

A few years ago, TSU partnered with the United Way of Metro Nashville to administer VITA, or Volunteer Income Tax Assistance program, an IRS initiative to offer free tax preparation services for low to middle-income individuals making $66,000 or less per year. Accounting students and other business majors in the COB, who have been certified by the IRS, along with their professors, administer the program.

A few years ago, TSU partnered with the United Way of Metro Nashville to administer VITA, or Volunteer Income Tax Assistance program, an IRS initiative to offer free tax preparation services for low to middle-income individuals making $66,000 or less per year. Accounting students and other business majors in the COB, who have been certified by the IRS, along with their professors, administer the program.

The free tax service is available every Saturday 9 a.m. – 5 p.m. on the Avon Williams Campus. It will continue to the end of the IRS tax-filing deadline.

“The College of Business is very pleased to offer this free service to the community,” says Dr. Millicent Lownes-Jackson, dean of the college. “This is also an ideal service-learning initiative of the college where our accounting majors are able to get practical hands-on experience while helping others.”

According to officials, between 30-40 returns are prepared each Saturday, and this filing season it is projected that 400-500 returns will be prepared. That’s up from 300 last season. Sixteen undergraduate and four graduate students are helping this year as part of their class work.

To participate in the program, volunteer students must take and pass Tax-1, Individual Income Tax, a required course and be certified by the IRS. Students get three hours of college credit as an accounting elective.

John R. Powers, a CPA and adjunct professor of accounting and business law, is the coordinator of the campus VITA program. He is responsible for the final quality of returns and files the completed returns electronically.

“Although this is a free service, we try to maximize the refund of any client, and that’s where I come in with my years of experience,” says Powers, majority owner of a Nashville accounting firm, who has been in the business for more than 30 years.

For the students, Power says, this is life experience whether they want to go into the tax field or not, it prepares them from a professional development standpoint.

Kathy Grant has met all requirements to participate in the VITA program and is helping for the first time this year. The senior accounting major says she is enjoying the “double” benefit the program offers.

“I am doing something to give back to the community, and I am also learning in the process,” says Grant, of Nashville, who wants to become a CPA “This is not just class, it is a business because I can use this education as I step out into the workforce.”

For Mariam Sadat, a senior, human resources major from Cairo, she is encouraged by the satisfaction people get from the services she and her fellow students provide.

“They are just too happy to know that they have avoided all the potential headaches with the free service,” says Sadat. “This is also a good practice for me to get this experience.”

Dr. Stephen Shanklin, CPA and interim chair of the Department of Accounting, who supervises the VITA program, says great emphasis is put on the quality of students selected for the program.

“Students with As and Bs are the ones we are looking for,” he says. “They can be from any discipline whatsoever in the college, but they have to have at least completed that course and have a desire to be tax preparers. And even at that they are not eligible until they interview with Prof. Powers.”

“In essence, we are preparing these students for the workplace,” adds Powers. “It is very important helping the community because we realize that the tax refund, no matter what amount, they are truly needed by the people who come here. So we prepare our students to do everything in accordance with the IRS code.”

For more information on the TSU VITA program and the free tax service, go to http://www.tnstate.edu/business/contact_us.aspx

Department of Media Relations

Tennessee State University

3500 John Merritt Boulevard

Nashville, Tennessee 37209

615.963.5331

About Tennessee State University

With more than 8,000 students, Tennessee State University is Nashville’s only public university, and is a comprehensive, urban, co-educational, land-grant university offering 38 bachelor’s degree programs, 25 master’s degree programs and seven doctoral degrees. TSU has earned a top 20 ranking for Historically Black Colleges and Universities according to U.S. News and World Report, and rated as one of the top universities in the country by Washington Monthly for social mobility, research and community service. Founded in 1912, Tennessee State University celebrated 100 years in Nashville during 2012. Visit the University online at tnstate.edu.